Description

Introduction: Welcome to the dynamic world of High-Frequency Trading (HFT) Strategies, where split-second decisions and cutting-edge algorithms drive the financial markets. This course is designed for individuals seeking to delve into the intricacies of algorithmic and quantitative trading, exploring the methodologies and tools employed in high-frequency trading strategies. Guided by industry experts, you will navigate through the fast-paced landscape of financial markets, understanding the nuances of HFT and mastering techniques to capitalize on fleeting market opportunities.

Course Description:

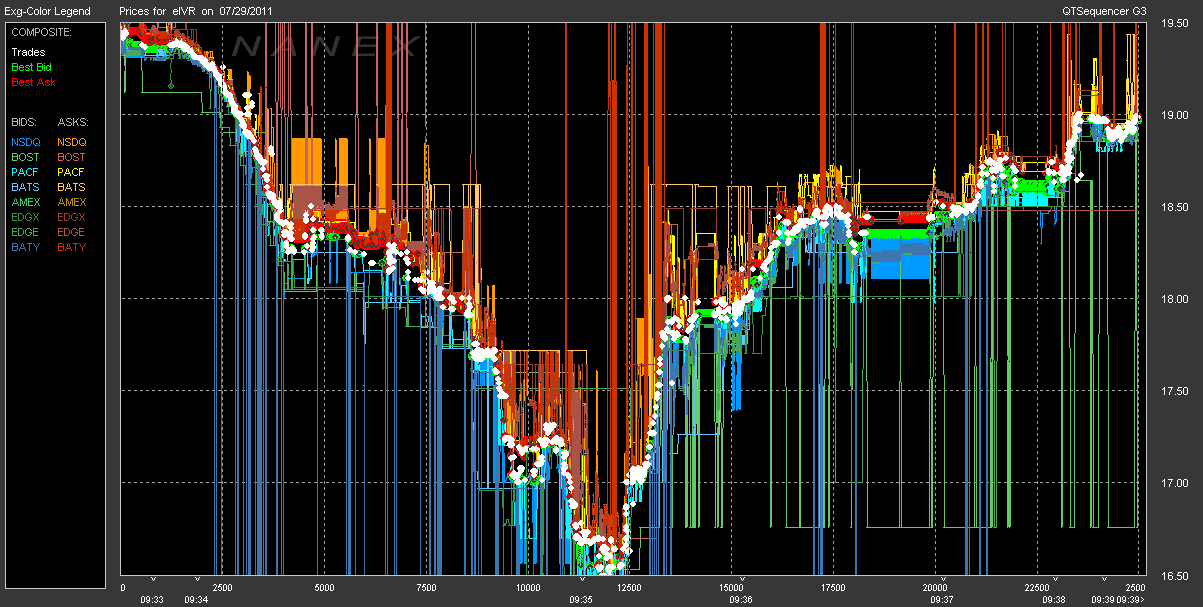

Module 1: Fundamentals of High-Frequency Trading Understand the core principles of high-frequency trading, exploring the historical context, evolution, and regulatory landscape. Gain insights into market microstructure and the role of technology in executing lightning-fast trades.

Module 2: Market Data and Analysis Learn to harness vast volumes of market data effectively. Dive into data cleaning, normalization, and analysis techniques crucial for identifying profitable trading opportunities in milliseconds.

Module 3: Algorithmic Strategies and Modeling Explore advanced algorithmic trading strategies, including market making, statistical arbitrage, and latency arbitrage. Develop models and algorithms designed for rapid execution in high-frequency trading environments.

Module 4: Risk Management in HFT Grasp the importance of risk management in high-frequency trading. Understand how to mitigate risks associated with high-speed trading systems, including market, operational, and technological risks.

Module 5: Technology and Infrastructure Examine the technological infrastructure required for successful high-frequency trading. Explore hardware, networking, and software components essential for building low-latency systems.

Module 6: Backtesting and Optimization Master the art of backtesting trading strategies in HFT. Learn to optimize algorithms for performance, considering factors such as transaction costs, slippage, and market impact.

Module 7: Live Trading Simulation Engage in a simulated trading environment to apply acquired knowledge practically. Experience real-time decision-making, execution, and monitoring of high-frequency trading strategies.

Valuable Points of the Course:

- Practical Application: Gain hands-on experience through simulations and practical exercises, applying theoretical concepts to real-world scenarios.

- Expert Insights: Benefit from industry experts and practitioners, understanding the latest trends, challenges, and best practices in HFT.

- Comprehensive Curriculum: Covering fundamental concepts to advanced strategies, ensuring a holistic understanding of high-frequency trading.

- Risk Management Emphasis: Focus on risk mitigation strategies crucial for maintaining stability in high-speed trading environments.

- Technology Integration: Learn about cutting-edge technologies and infrastructure needed for successful HFT operations.

- Networking Opportunities: Connect with like-minded individuals, fostering a network within the algorithmic trading community.

Enroll in this course to explore the adrenaline-fueled realm of High-Frequency Trading Strategies and equip yourself with the tools to thrive in the fast-paced world of quantitative finance.