Description

Introduction: Market Microstructure and Liquidity form the bedrock of modern financial markets, influencing how securities are traded, prices are formed, and liquidity is managed. In this advanced course within the Algorithmic and Quantitative Trading domain, participants delve deep into understanding the intricate mechanisms governing markets, exploring the nuances of trading strategies and risk management within these frameworks.

Course Description:

Module 1: Foundations of Market Microstructure

- Understanding Market Participants: Explore the roles and behaviors of market participants, including market makers, high-frequency traders, institutional investors, and their impact on market dynamics.

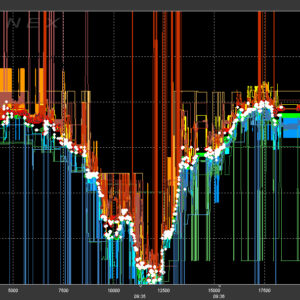

- Order Types and Book Structures: Analyze various order types, order books, and their role in price discovery and market efficiency.

- Auction Mechanisms: Examine the different auction types such as opening and closing auctions, their impact on liquidity, and trading strategies around these events.

Module 2: Market Liquidity and Efficiency

- Liquidity Measures and Metrics: Study liquidity measures, including bid-ask spreads, depth, and impact cost, and their implications on trading strategies and execution.

- Price Formation and Information Flow: Explore how information dissemination influences price discovery and efficiency within markets.

- Market Impact and Execution Strategies: Understand market impact models and develop effective execution strategies to minimize impact costs in different market conditions.

Module 3: High-Frequency Trading and Market Dynamics

- High-Frequency Trading (HFT) Strategies: Analyze various HFT strategies, their benefits, and the challenges they pose to market stability and fairness.

- Market Fragmentation: Explore the impact of fragmented markets on liquidity and execution, and strategies to navigate diverse trading venues.

- Regulatory Landscape: Discuss regulatory frameworks governing market microstructure and liquidity, and their implications for trading strategies and market participants.

Module 4: Risk Management and Optimization

- Market Risk and Uncertainty: Assess risks associated with market microstructure, liquidity shocks, and algorithmic trading, and develop robust risk management strategies.

- Optimization Techniques: Apply optimization techniques to enhance trading strategies considering market microstructure constraints and liquidity dynamics.

- Case Studies and Practical Applications: Analyze real-world case studies to apply theoretical concepts, optimizing strategies for diverse market conditions.

Valuable Points of the Course:

- Practical Insights: Gain practical insights into market microstructure, enabling participants to implement effective trading strategies in real-world scenarios.

- In-depth Analysis: Dive deep into the nuances of liquidity, order types, and market dynamics, empowering traders to make informed decisions.

- Risk Management Focus: Emphasize risk management strategies tailored to address challenges arising from market microstructure and liquidity fluctuations.

- Regulatory Perspective: Understand the evolving regulatory landscape, ensuring compliance and adaptability in an ever-changing market environment.

- Hands-on Experience: Engage in hands-on exercises, simulations, and case studies to reinforce theoretical concepts and optimize trading strategies.

This course is designed for quantitative analysts, algorithmic traders, portfolio managers, and anyone seeking an advanced understanding of how market microstructure and liquidity impact trading strategies and risk management in financial markets. Participants will leave equipped with actionable insights to navigate and thrive in dynamic trading environments.