Description

Introduction: Welcome to the comprehensive guide on Candlestick Patterns and Interpretation! In this course, delve into the fascinating world of technical analysis as we explore the nuances of candlestick patterns, their significance, and how they aid in interpreting market movements. Whether you’re a novice trader or an experienced investor, understanding candlestick patterns can be a powerful tool in your arsenal, enabling you to make informed decisions in the dynamic realm of financial markets.

Course Description:

Module 1: Introduction to Candlestick Patterns Get acquainted with the fundamentals of candlestick charts, their origins, and their role in technical analysis. Understand the basic anatomy of candlesticks, from open and close prices to wicks and shadows. Explore how these patterns form and the psychology behind their representation of market sentiment.

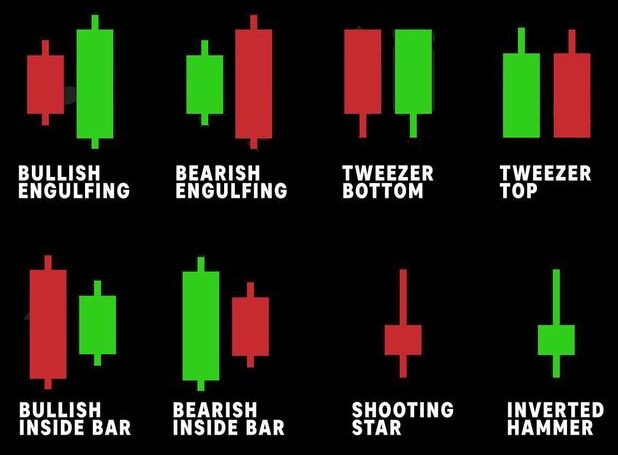

Module 2: Single Candlestick Patterns Dive into the various single candlestick patterns such as Doji, Hammer, Shooting Star, and more. Learn to recognize these individual patterns and decipher their implications for market trends, reversals, and indecision.

Module 3: Dual Candlestick Patterns Explore the significance of dual candlestick patterns like Bullish/Bearish Engulfing, Tweezer Tops/Bottoms, and Harami patterns. Understand how these combinations of candlesticks offer deeper insights into potential market movements.

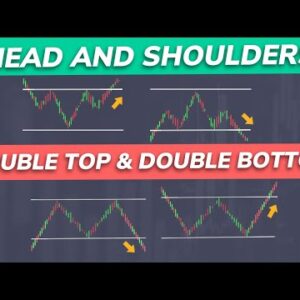

Module 4: Triple Candlestick Patterns Delve into the complexities of triple candlestick patterns such as Morning/Evening Star, Three White Soldiers/Three Black Crows, and their relevance in forecasting trend reversals or continuations.

Module 5: Practical Application and Interpretation Apply your knowledge through case studies and real-time chart analysis. Learn how to integrate candlestick patterns into your trading strategy effectively. Understand the importance of combining these patterns with other technical indicators for enhanced accuracy and decision-making.

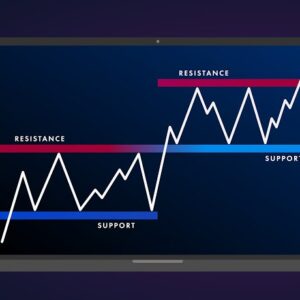

Module 6: Advanced Candlestick Strategies Discover advanced strategies involving candlestick patterns, including Fibonacci retracements, support and resistance levels, and volume analysis. Learn to spot confluence areas and strengthen your ability to make informed trading decisions.

Module 7: Risk Management and Trading Psychology Understand the significance of risk management in trading and how to incorporate candlestick patterns within a disciplined trading plan. Explore the psychological aspects of trading and how emotions can influence interpretation and decision-making.

Conclusion: By the end of this course, you’ll have a profound understanding of candlestick patterns and their interpretation. Equipped with this knowledge, you’ll be better prepared to navigate the intricacies of financial markets, identify potential opportunities, and mitigate risks effectively.

Valuable Points of the Course:

- In-depth exploration from basic to advanced candlestick patterns.

- Practical application through case studies and real-time chart analysis.

- Emphasis on combining candlestick patterns with other technical indicators.

- Insights into risk management and trading psychology.

- Strategies for integrating patterns into a comprehensive trading plan.

Enroll in this course today and unlock the power of candlestick patterns in your journey towards becoming a more astute and successful trader!