Description

Introduction: Welcome to Trendline Analysis, an in-depth course designed to empower learners with the knowledge and skills to interpret and utilize trendlines effectively in technical analysis. This course caters to both novice traders seeking foundational understanding and seasoned investors aiming to refine their analytical abilities. Trendlines are vital tools in chart analysis, providing invaluable insights into market trends, potential reversals, and crucial support and resistance levels.

Course Description:

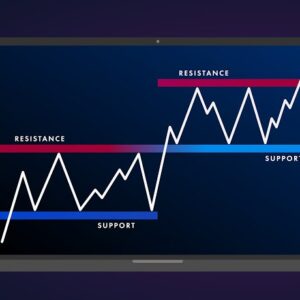

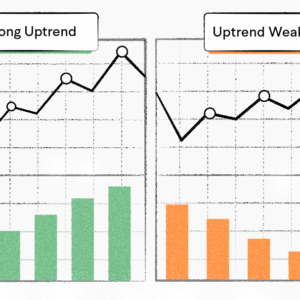

Module 1: Understanding Market Trends In this foundational module, participants will grasp the fundamentals of market trends. From identifying different types of trends to comprehending the psychology behind price movements, learners will lay the groundwork for interpreting trendlines effectively.

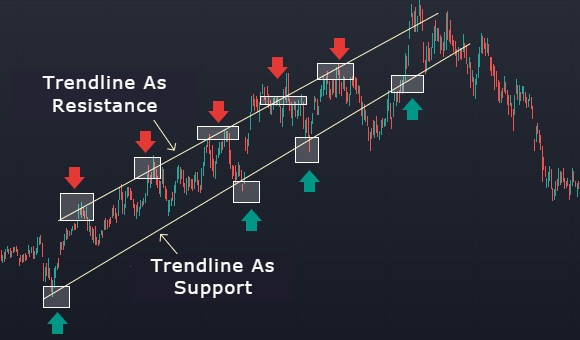

Module 2: Introduction to Trendline Analysis This module delves into the core principles of trendline analysis. Participants will learn how to draw and validate trendlines accurately, exploring various chart patterns and understanding their significance in predicting future price movements.

Module 3: Types of Trendlines Building upon the basics, this module delves deeper into the nuances of trendlines. Students will explore different types of trendlines—such as upward, downward, and horizontal—and understand how each type reflects market sentiment and potential trading opportunities.

Module 4: Drawing and Validating Trendlines Practical application is key. This module equips learners with hands-on experience in drawing and validating trendlines on real-market charts. Participants will gain proficiency in identifying reliable trendlines and filtering out noise to make informed trading decisions.

Module 5: Advanced Trendline Strategies Dive into advanced techniques and strategies involving trendlines. From understanding trendline breaks to utilizing multiple timeframes and combining trendlines with other technical indicators, participants will develop a comprehensive approach to maximize their trading potential.

Module 6: Case Studies and Practical Applications This module presents real-world case studies and scenarios, allowing learners to apply their acquired knowledge. Analyze historical charts, interpret trendline patterns, and devise trading strategies based on the principles learned throughout the course.

Module 7: Risk Management and Trade Execution Managing risk is paramount in trading. Here, participants will learn how to integrate trendline analysis into their risk management strategies and execute trades efficiently while mitigating potential downsides.

Most Valuable Points:

- Practical Application: The course emphasizes practicality, ensuring participants gain hands-on experience in drawing, validating, and utilizing trendlines on actual market data.

- Advanced Strategies: From identifying trend reversals to combining trendlines with other technical indicators, learners explore advanced strategies to enhance their trading prowess.

- Real-world Case Studies: The inclusion of case studies allows participants to apply their knowledge to actual market scenarios, reinforcing their understanding of trendline analysis.

- Risk Management Focus: Understanding the importance of risk management in trading, the course incorporates risk mitigation strategies specific to trendline analysis, ensuring participants can trade with confidence and discipline.

By the end of this course, participants will have honed their skills in trendline analysis, equipping them to make informed trading decisions, identify potential market opportunities, and manage risks effectively in the dynamic world of financial markets.