Description

Introduction: Welcome to the world of financial derivatives! This course, “Introduction to Derivatives,” is designed to provide a comprehensive understanding of the fundamental concepts and applications of derivatives in financial markets. Whether you’re an aspiring finance professional or someone eager to grasp the intricacies of derivative instruments, this course will serve as your gateway to this dynamic and essential aspect of modern finance.

Description:

Module 1: Understanding Derivatives

- Introduction to Derivatives: Explore the foundational principles of derivatives, their role in financial markets, and their significance in risk management and speculation.

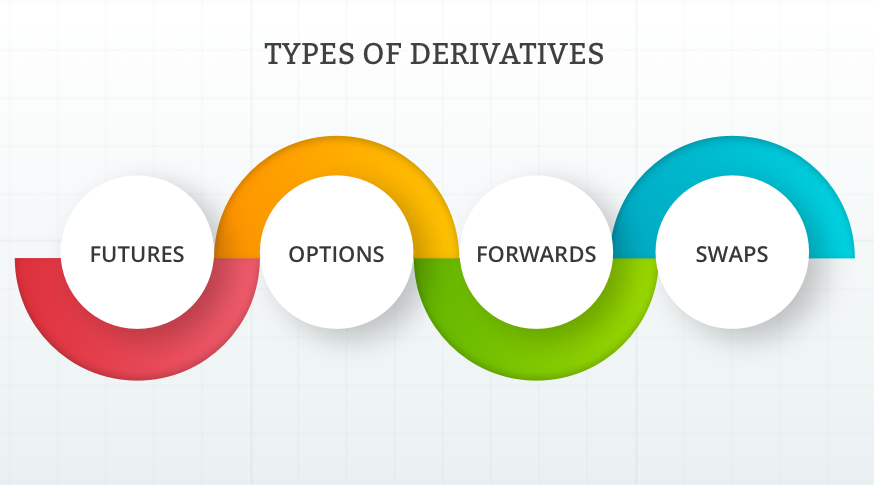

- Types of Derivatives: Dive into the various types of derivatives, including futures, options, forwards, and swaps, understanding their distinctive features and applications.

Module 2: Basics of Futures and Forwards

- Futures Contracts: Learn about futures contracts, their mechanics, pricing, and how they’re used for hedging and speculation.

- Forward Contracts: Understand the nuances of forward contracts, their differences from futures, and their practical applications in managing risk.

Module 3: Options: Basics and Strategies

- Introduction to Options: Grasp the fundamentals of options, including call and put options, intrinsic value, time value, and option pricing models.

- Option Strategies: Explore various options strategies, such as covered calls, protective puts, straddles, and spreads, and learn how to employ them effectively.

Module 4: Swaps and Advanced Concepts

- Swaps: Delve into interest rate swaps, currency swaps, and other types of swaps, understanding their structure, valuation, and uses in mitigating risk.

- Advanced Concepts: Explore advanced topics like exotic options, derivative pricing models (Black-Scholes, Binomial Model), and the role of derivatives in financial crises.

Valuable Points of the Course:

- Practical Applications: Gain hands-on experience through case studies and simulations, applying derivative strategies to real-world scenarios.

- Risk Management: Understand how derivatives serve as powerful tools in managing and mitigating financial risk for individuals and institutions.

- Investment Strategies: Learn how derivatives can be used for strategic investment purposes, enhancing portfolio performance and diversification.

- Expert Guidance: Benefit from insights shared by industry experts and practitioners, providing practical perspectives and industry-relevant knowledge.

- Interactive Learning: Engage in discussions, quizzes, and interactive sessions to solidify your understanding of derivative concepts and their applications.

This course aims to equip you with a solid foundation in derivatives, empowering you to navigate the complexities of financial markets confidently. Whether you aspire to excel in finance, risk management, or investments, this course will lay the groundwork for your success in the world of derivatives.