Description

Introduction: Welcome to the comprehensive “Introduction to Technical Analysis” course designed for individuals eager to delve into the intricate world of financial markets. This course provides a foundational understanding of technical analysis, an essential skillset for anyone interested in trading, investing, or analyzing financial assets. Through this program, participants will gain insights into market trends, patterns, and indicators crucial for informed decision-making in the dynamic realm of finance.

Course Description: The “Introduction to Technical Analysis” course is structured to equip learners with a solid foundation in analyzing market behavior using charts, patterns, and indicators. The curriculum is carefully crafted to accommodate beginners and intermediate-level learners seeking to understand the principles and applications of technical analysis.

Modules:

- Fundamentals of Technical Analysis:

- Introduction to market analysis methods

- Understanding price action and market psychology

- Charting Techniques:

- Reading and interpreting different types of charts (line, bar, candlestick)

- Drawing trendlines, support, and resistance levels

- Key Technical Indicators:

- Exploring moving averages and their significance

- Introduction to oscillators and momentum indicators

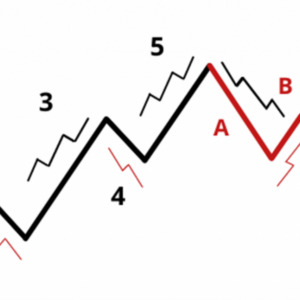

- Common Chart Patterns:

- Identification and interpretation of chart patterns (head and shoulders, triangles, flags, etc.)

- Recognizing the implications of patterns on price movements

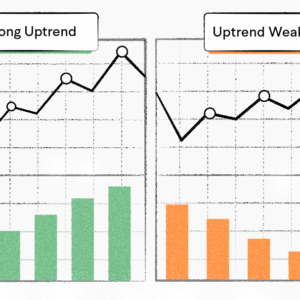

- Volume Analysis:

- Understanding volume and its role in confirming price trends

- Utilizing volume indicators for better decision-making

- Risk Management and Strategy Development:

- Implementing risk management techniques in technical analysis

- Developing trading strategies based on technical indicators and patterns

Valuable Points of the Course:

- Practical Application: The course emphasizes hands-on learning, allowing participants to apply theoretical concepts to real-world scenarios through practical exercises and case studies.

- Comprehensive Understanding: Participants will gain a comprehensive understanding of various technical analysis tools, enabling them to make informed predictions and decisions in the financial markets.

- Expert Guidance: Learn from industry experts with extensive experience in trading and technical analysis, gaining insights and tips from their practical knowledge.

- Customized Learning: The course structure is designed to cater to diverse learning styles, ensuring that participants at different levels of expertise can grasp the concepts effectively.

- Interactive Learning Environment: Engage in discussions, quizzes, and interactive sessions to reinforce learning and clarify doubts, fostering a collaborative learning environment.

Upon completion of this course, participants will possess a solid foundation in technical analysis, enabling them to interpret market trends, identify potential opportunities, and make informed decisions when trading or investing in financial instruments. Join us in unlocking the secrets of market analysis and gain the skills necessary to navigate the complexities of the financial world confidently.