Description

Introduction: The world of finance is increasingly reliant on quantitative techniques and algorithmic strategies for making informed decisions. This comprehensive course in Quantitative Analysis and Modeling delves into the core principles, methodologies, and tools essential for individuals aspiring to excel in the domain of Algorithmic and Quantitative Trading. Participants will gain a deep understanding of quantitative methods used in financial markets, enabling them to design robust trading strategies, assess risk, and optimize investment decisions.

Course Overview:

Module 1: Foundations of Quantitative Analysis

- Introduction to Quantitative Finance: Explore the fundamentals of quantitative finance, including time series analysis, probability, and statistics as applied to financial markets.

- Mathematical Foundations: Dive into the mathematical underpinnings essential for financial modeling, covering calculus, linear algebra, and stochastic calculus.

Module 2: Data Analysis for Trading

- Data Collection and Preprocessing: Learn techniques for gathering and cleaning financial data from various sources, ensuring it’s suitable for analysis.

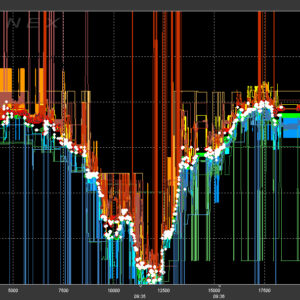

- Exploratory Data Analysis: Understand how to visually and statistically analyze financial data to derive insights and identify patterns.

Module 3: Quantitative Modeling Techniques

- Statistical Modeling: Study regression analysis, time series modeling, and hypothesis testing for financial data.

- Machine Learning for Trading: Explore machine learning algorithms such as neural networks, decision trees, and ensemble methods applied to trading strategies.

Module 4: Algorithmic Trading Strategies

- Strategy Development: Learn to design and implement quantitative trading strategies using mathematical models and statistical techniques.

- Backtesting and Performance Evaluation: Understand the importance of rigorous testing and evaluation of trading strategies using historical data.

Module 5: Risk Management and Portfolio Optimization

- Risk Measurement: Explore methods for measuring and managing risk in trading portfolios, including value-at-risk (VaR) and stress testing.

- Portfolio Optimization: Learn modern portfolio theory and optimization techniques to construct diversified and efficient portfolios.

Module 6: Advanced Topics in Quantitative Trading

- High-Frequency Trading (HFT) Techniques: Understand the principles and challenges of high-frequency trading strategies.

- Quantitative Risk Modeling: Delve into advanced risk modeling techniques like Monte Carlo simulation and volatility modeling.

Valuable Points of the Course:

- Hands-On Experience: Practical exercises and projects using real-world financial data to reinforce theoretical concepts.

- Expert Instruction: Guidance from seasoned professionals and industry experts with vast experience in quantitative trading.

- Application-Oriented Learning: Emphasis on applying quantitative techniques to create and optimize trading strategies.

- Industry-Relevant Skills: Acquire skills highly sought after in the finance and trading industry.

- Interactive Learning Environment: Engaging discussions, case studies, and peer-to-peer interaction within a supportive online community.

This course is designed for finance professionals, traders, analysts, or anyone keen on harnessing quantitative methods to navigate the complexities of financial markets. Upon completion, participants will possess the skills and knowledge to build, test, and implement sophisticated quantitative trading strategies effectively.