Description

Introduction: Welcome to the comprehensive course on Volume Analysis and Price-Volume Relationship! This course delves deep into the crucial aspects of technical analysis, focusing specifically on understanding the intricacies of volume in trading and its correlation with price movements. Through a blend of theoretical concepts, real-world case studies, and practical application, participants will gain a profound understanding of how volume affects market dynamics and shapes price action.

Course Description:

Module 1: Foundations of Volume Analysis In this module, participants will establish a strong foundation by comprehending the fundamental principles of volume analysis. Topics covered include understanding volume data, interpreting volume bars, identifying volume patterns, and the significance of volume in technical analysis.

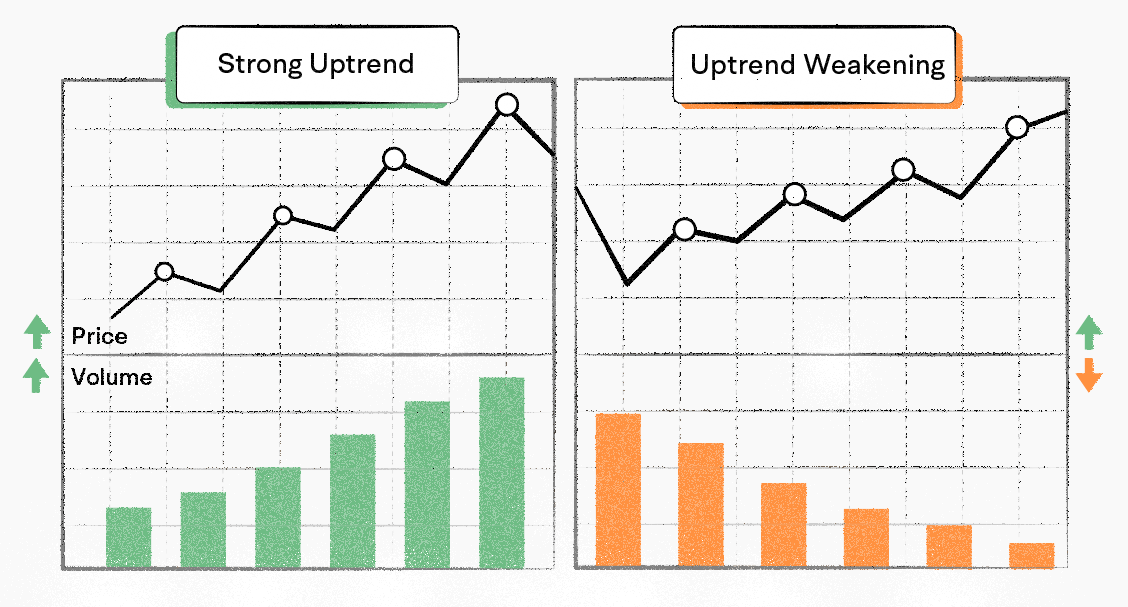

Module 2: Price-Volume Relationship This module explores the intricate relationship between price movements and volume. Participants will learn how to interpret price-volume charts, identify trends, and analyze volume in conjunction with price movements to make informed trading decisions.

Module 3: Volume Indicators and Tools Participants will dive into various volume indicators and tools available for traders. From On-Balance Volume (OBV) to Accumulation/Distribution indicators, this module provides a comprehensive overview of these tools’ applications and how to effectively integrate them into trading strategies.

Module 4: Volume Patterns and Signals This section focuses on recognizing different volume patterns and signals. Participants will learn to identify accumulation and distribution phases, spotting volume spikes, and interpreting volume-based chart patterns like volume clusters and gaps.

Module 5: Advanced Strategies and Case Studies Building upon the foundational knowledge, this module delves into advanced trading strategies that leverage volume analysis. Through case studies and real-time examples, participants will gain insights into applying volume-based strategies across various markets and trading scenarios.

Module 6: Risk Management and Practical Application The final module emphasizes risk management strategies tailored for volume-based trading. Participants will understand how to manage risks effectively while implementing volume analysis in their trading routines. Practical exercises and simulations will reinforce their understanding and application of concepts learned throughout the course.

Course Highlights:

- Comprehensive understanding of volume analysis and its impact on price movements.

- In-depth exploration of volume indicators, tools, and their practical applications.

- Identification and interpretation of volume patterns and signals for informed decision-making.

- Real-world case studies and practical exercises for hands-on learning.

- Advanced strategies leveraging volume analysis for diverse trading scenarios.

- Emphasis on risk management techniques tailored to volume-based trading.

By the end of this course, participants will emerge with a robust understanding of volume analysis, equipped with the knowledge and skills to leverage volume data effectively in their trading endeavors. Whether you’re a novice trader or an experienced investor, this course will empower you to navigate the markets with confidence using volume as a key analytical tool.